Volvo Construction Equipment shows consistent profitability despite market pressures in Q3 2025

During the third quarter, the global machine market grew compared to last year. When looking at the different markets Europe, North America and Asia grew, while South America contracted.

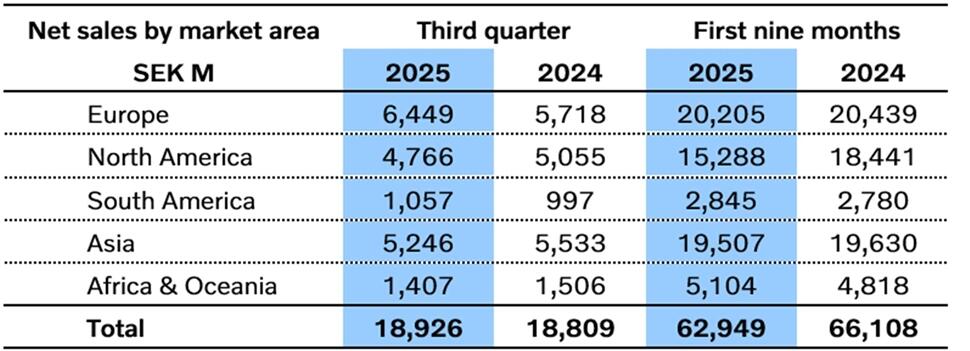

Net sales increased by 1% to SEK 18,926 M, adjusted for currency movements, net sales increased by 8%. Excluding SDLG the increase was 14%, of which machine sales increased by 17% and service sales increased by 6%. Adjusted operating income increased to SEK 2,722 M, corresponding to an adjusted operating margin of 14.4%. Compared with Q3 2024, a positive product mix and an improved service business offset increased tariff costs and lower volumes.

The third quarter saw a net order intake decrease by 2%, impacted by the divestment of SDLG. Adjusting for SDLG, order intake increased by 22%. Order intake for the Volvo brand was driven by continued dealer inventory replenishment in Europe and resizing of fleets and stock levels in North America preparing for 2026. Deliveries in Q3 were 4% lower than in the prior year, driven by the divestment of SDLG. Adjusting for SDLG, deliveries increased by 14%. The Volvo brand had higher deliveries in Europe and the Middle East, which were partly offset by lower deliveries in North America as dealers balance their inventory levels.

Strategic events during the third quarter

On September 1, Volvo CE completed the previously announced divestment of its ownership stake in China-based SDLG, which enables Volvo CE to focus on Volvo-branded solutions within its targeted segments. It also allows Volvo CE to further capitalize on its strong industrial presence in China, supported by both its assembly and technology centers. Volvo CE also continued the rollout of its recently launched products, with events for the latest articulated haulers across Asia.

Melker Jernberg, Head of Volvo CE, said: “Despite a quarter characterized by global market uncertainty, we have continued to demonstrate resilience and deliver a solid performance throughout. The completion of the SDLG divestment allowed us to further sharpen our focus, capitalizing on our robust industrial presence in China while making substantial investments in our manufacturing footprint globally. During the quarter, we also continued our largest-ever product launch, alongside the introduction of new services, now expanding to additional continents and markets.”

Market development

In Q3, the total market in Europe grew for the first time in more than a year, with support from major markets, such as Germany and the UK, while France and Italy contracted. The North American market also grew, partly driven by anticipation of higher prices due to tariffs. In South America, the market declined, driven by Brazil, while sentiment was more in other markets, such as Argentina and Colombia. The Chinese market continued to grow, following governmental policies to stimulate the real estate sector, which mainly drives demand for smaller machines. Asia excluding China as a region showed growth, as well as Southeast Asia, the Middle East and Turkey. Japan and South Korea and the Indian market declined.

Table 1. Volvo Construction Equipment, net sales by market area, in Millions of Swedish Krona (SEK).

Downloads

FOR FURTHER INFORMATION

Åsa Alström

Head of Strategic Communications

Volvo Construction Equipment

E-mail: asa.alstrom@volvo.com